Hi, I'm Rahul Nain! Customer-focused Product Manager with a passion for solving real customer problems and driving conversions into paying customers. Proven expertise in balancing customer insights, data-driven decision-making, and stakeholder collaboration to achieve measurable business outcomes.'MBA @BITS Pilani | B.Tech (I.T) @SRMIST, Chennai'

Brings a unique blend of 2 years of entrepreneurial experience and 1.5 years of hands-on product management expertise in NBFC, BFSI, and Stock Broking firms.Nothing interests me more than people who are pursuing or building something which is changing the world in its very own way; feel free to drop me a message!

Product Management:

Product Manager (BFSI & Broking) - Wealthy.in - (Feb'24 - Current)

Onboarding & KYC Transformation

Led the revamp of onboarding and KYC journeys for Residents, NRIs, and Joint Accounts, expanding the customer base by 20% and increasing AUM by 35%+. Enhanced user experience and compliance, improving completion rates by 17% and reducing support tickets by 40%.

Platform Scalability & Integrations

Enabled multi-PAN account creation under a unified identity, improving account management flexibility. Integrated key KYC verification systems (PAN Check, RPD, AA, CAMS KRA) to speed up investment readiness and led the mutual fund distributor onboarding platform for a seamless digital ARN, and KYC.

Payments & Insurance Expansion

Introduced CAMSPay as a fallback payment option to reduce drop-offs and improve transaction reliability.

Led the development of Term and Health Insurance integrations, enabling complete policy purchase journeys from plan comparison to payment.

Product Management

(FinTech - NBFC)

(2023)

Implemented Reverse Penny Drop solution and replaced with existing penny drop system to increase its success rate.Introduced Account Aggregator solution to activate FnO, and replaced existing bank statement upload system.Implemented Joint Account Mutual Fund KYC onboarding, and enabling a complete new target market segment.

Tech Entrepreneur

(At Stealth Mode)

(2021-2023)

Mastered key aspects of entrepreneurship including developing the opportunity, launching startup, growth strategies, financing, and profitability.Projects: E-commerce (Flash Sale) · Marketplace (Similar to MMT) · RERA Housing

Certifications:

AI Product Manager

From: IBM(Currently in progress)

AML and KYC

From: Indian Institute of Banking and Finance (IIBF)

High-Level Sys Design

From: Udemy

PM Case Studies: (2023 - old)

WhatsApp UPI Payment

Whatsapp released the feature of ‘UPI Payments’ a couple of years ago but apps like PhonePe, Google Pay, and PayTM are far ahead with a lesser reach than Whatsapp.How can we increase the monthly WhatsApp UPI Payments volumes by 5 times? Assume there are no regulatory hurdles.

Payment Gateway

You are a Product Manager in one of India's largest Paymet Gateway. Over the past month, the success rate of transactions on your payment gateway has dropped to 92% from 98%.Detail a structured analysis to pinpoint possible issues and articulate the problem clearly - backing your reasoning strongly

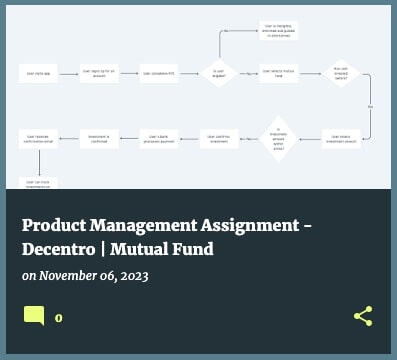

Mutual Fund

Launching a new module that will help individuals invest in mutual funds.a) Share a high-level customer journey of the same including the flow and process.

b) Build a set of APIs that can be consumed by a business that wants to launch investments on their app including payments.

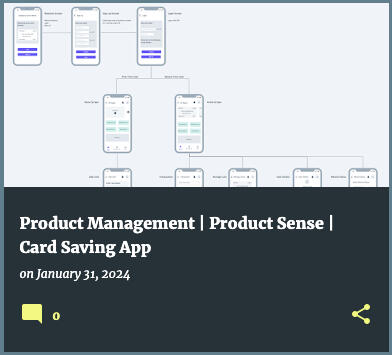

Card Saving App

Imagine you are a PM at Safexpay and have been instructed to design the consumer facing app to help the end consumers of our Payment Aggregation business monitor their transactions, manage their saved cards and check the status of refunds etc. Make the app as comprehensive as possible with

options to monetise it.

Amazon Drop-off

As a product manager overseeing the purchase flow on Amazon e-commerce, from the moment a user enters a product listing page to the point of making a purchase.- If your purchase conversion declined by 5% week over week (WoW), how would you analyze the factors contributing to this impact?

Airport Case

This was a tricky situation as Frankfurt Airport was notoriously big and confusing. In the worst-case scenario, she might need up to 15-20 min to reach the gate allocated to her.Fact that she didn’t know German was not helping either. Anyway, She realized she has few options.

Books

Auth-n-Capture

FinTech, especially digital payments, is a fascinating space. More than trillion dollars’ worth of digital payments are done, and we are ‘just getting started’. Online payments space is attractive and intriguing to many.A beginner’s guide for FinTech enthusiasts and professionals to understand the basics of India’s payments ecosystems.

The Anatomy of the Swipe

Have you ever wondered what happens during a swipe of a credit card? Every major tech company will become a payments company.- How does money move from my credit card to my favorite coffee shop?

- How can I build a neo-bank?

- How can I build my own debit or credit card?

- How can I accept card based payments?

Tech Simplified

Anyone working with software developers will find it hard to connect and communicate if they don't understand tech. There are other benefits to understanding tech too. You can build empathy for the development team working day and night with you. This creates mutual trust and respect, which makes it easy to work and get work done. Having tech understanding also helps in building your confidence as a PM.

Online Courses

FinTech: Shaping the Financial World

This course about financial technology, or FinTech, is for students wishing to explore the ways in which new technologies are disrupting the financial services industry—driving material change in business models, products, applications and customer user interface.- By MIT OpenCourseWare

Entrepreneurship Specialization

Wharton's Entrepreneurship Specialization covers the conception, design, organization, and management of new enterprises. This five-course series is designed to take you from opportunity identification through launch, growth, financing and profitability.- By Wharton Online

Startup School

Learn how to build a top startup - from the same people who helped Airbnb, Doordash, Stripe, Reddit, and Coinbase get started.

Innovation, Growth Mindset, Goal Oriented, Strategic Planning, Presentation, Communication, Negotiation, Agile, Scrum, Digital Marketing, MVP Development- By Y Combinator

Straightforward, easy-to-understand definitions of the payments industry

Get In Touch With Me!

........

Forms are boring, so I've kept it short. Don't forget to leave your name!